Tired of trading hours for dollars? You’re not alone — more and more young people in 2025 are turning to passive income as a smarter, more flexible way to build wealth. And when it comes to choosing the best path, one question dominates the conversation: stocks vs crypto — which one works best for building passive income?

Whether you’re trying to earn while you sleep or just want to stop stressing about your next paycheck, this topic matters. You’re in the perfect stage of life — 20s or 30s — to build momentum now and let time do the heavy lifting.

But here’s the catch: both stocks and crypto offer passive income… just in totally different ways. One gives you steady dividends and long-term reliability. The other promises sky-high returns (with a side of chaos). Which one makes sense for you?

In this article, we’ll break it all down clearly and practically — no jargon, no fluff. You’ll learn how each investment works, what to expect in 2025, and how to build a strategy that actually fits your life.

Let’s dive into the world of stocks vs crypto and find out which path to passive income is right for you.

Table of Contents

What Is Passive Income—and Why Does It Matter in 2025?

When comparing stocks vs crypto for long-term gains, it’s essential to understand the foundation: passive income. In 2025, more people than ever are shifting their mindset from earning only through active work to building income streams that run in the background.

What Is Passive Income?

Passive income is money earned with minimal ongoing effort after the initial setup. It’s not about doing nothing — it’s about creating systems that work for you while you sleep, travel, or focus on other goals.

Examples include:

- Dividends from stock investments

- Crypto staking rewards

- Rental income from property

- Royalties from content or products

Unlike a 9-to-5 job, where you trade time for money, passive income lets your money (or assets) work for you.

Why It Matters in 2025

In today’s economy, depending solely on a paycheck is risky. Inflation, job automation, and unpredictable markets make financial stability harder to maintain. That’s why young investors are exploring stocks vs crypto not just for growth, but for recurring income.

Here’s why passive income matters more than ever:

- 💡 Inflation-resistant: Your money doesn’t just sit — it grows.

- 📈 Wealth-building: Passive income accelerates financial independence.

- 🧘♂️ Freedom-focused: It opens up time for travel, learning, and passion projects.

- 🔄 Diversification: Multiple income sources protect you from financial shocks.

Stocks and Crypto as Passive Tools

Both stocks and crypto offer modern ways to generate passive income — but they work differently.

- Stocks pay regular dividends and grow over time with less volatility.

- Crypto offers high-yield options like staking, but with higher risks.

Understanding passive income is the first step to making an informed choice in the stocks vs crypto debate.

✅ Whether you’re building your first portfolio or scaling existing assets, mastering passive income strategies in 2025 is no longer optional — it’s essential.

Investing in Stocks for Passive Income

In the stocks vs crypto debate, stocks remain a proven and accessible way to earn consistent passive income — especially for those who value stability and long-term growth. Unlike crypto’s wild swings, the stock market offers structured, regulated opportunities to build wealth steadily.

How Do Stocks Generate Passive Income?

The main way to earn passive income from stocks is through dividends — regular payments companies make to shareholders from their profits. Some companies pay dividends quarterly, while others may do so monthly or annually.

You can also benefit from capital appreciation, where your stock’s value increases over time. While this isn’t passive income in the strict sense, it still contributes to your financial growth with no extra effort on your part.

Why Stocks Still Work in 2025

Stocks may not offer the explosive short-term returns of crypto, but they shine in reliability. Here’s why many young investors are choosing stocks:

- 📊 Stability: Backed by decades of performance data and strong regulation.

- 🧩 Diversification: Easy access to sectors like tech, healthcare, and real estate.

- 💸 Automation: Use tools like Dividend Reinvestment Plans (DRIPs) or robo-advisors to reinvest profits without lifting a finger.

Best Types of Stocks for Passive Income

To build a solid stream of income, focus on assets known for reliable payouts:

- Dividend Aristocrats: Companies that have increased dividends for 25+ years.

- REITs (Real Estate Investment Trusts): Required by law to pay out 90% of income.

- ETFs: Offer broad exposure and often pay dividends while reducing risk.

These are especially beginner-friendly, require low capital to start, and can be managed from your phone.

Real Talk: The Downsides

Even with their advantages, stocks aren’t perfect:

- 📉 Market fluctuations can reduce your portfolio value short-term.

- 🏛 Taxes on dividends vary by country and can eat into returns.

- 🕒 Patience is required — returns build slowly compared to high-yield crypto platforms.

Still, for those who want a safer entry into passive income, stocks are a top contender.

💡 If you’re just starting and wondering where to begin in the stocks vs crypto conversation, building a dividend-focused stock portfolio is one of the smartest first steps.

Investing in Crypto for Passive Income

When comparing stocks vs crypto in 2025, crypto stands out for its high-yield potential and rapid innovation. While stocks offer steady dividends, crypto unlocks new forms of passive income through decentralized finance (DeFi), staking, and yield-generating platforms.

How Crypto Generates Passive Income

Crypto doesn’t pay dividends like traditional stocks — instead, it offers multiple modern tools to earn passively:

- Staking: Locking your crypto (e.g., ETH, SOL, DOT) to support network operations and earn rewards.

- Yield farming: Lending crypto to liquidity pools for high annual percentage yields (APYs).

- Crypto savings accounts: Platforms like Nexo or Binance Earn offer interest on held assets.

- Node operation or validation: For advanced users earning passive income by supporting blockchains.

These methods can generate returns far beyond what traditional banks or dividend stocks offer — but they come with more complexity and risk.

Why Young Investors Love Crypto in 2025

Crypto has become a go-to passive income stream for the digital-native generation. Here’s why:

- 🚀 High returns: Many staking programs offer 5–15% APY or more.

- 🌍 24/7 access: No market close. Manage income anytime from your phone.

- 🧠 Innovation-driven: DeFi platforms, DAOs, and NFTs constantly create new income models.

Top Crypto Assets for Passive Income

Some cryptos are better suited for passive strategies than others:

- Ethereum (ETH) – Widely staked post-merge.

- Solana (SOL) – Low fees and high-speed transactions.

- Polkadot (DOT) & Avalanche (AVAX) – Popular for staking rewards.

- Stablecoins (USDC, USDT) – Used in crypto savings for safer, fixed-income returns.

These options balance accessibility, risk, and income potential.

Risks You Should Know

Crypto may be exciting, but it’s not risk-free. Here’s what to watch for:

- ⚠️ Volatility: Prices can crash fast, reducing your principal.

- 🛡 Platform risk: Exchanges or DeFi platforms can be hacked or go bankrupt.

- 📜 Regulatory uncertainty: Laws around crypto income and staking vary by country and are still evolving.

To reduce risk, stick with trusted platforms, diversify your assets, and never invest more than you can afford to lose.

💡 In the ongoing stocks vs crypto debate, crypto offers unmatched earning potential — but only for those ready to learn, adapt, and manage the risks.

Stocks vs Crypto: Side-by-Side Comparison

When it comes to building passive income in 2025, the stocks vs crypto decision often comes down to personal goals, risk tolerance, and time horizon. Both offer unique advantages — but they operate in very different ways.

To help you choose wisely, here’s a clear side-by-side breakdown of how stocks and crypto compare across the most important factors:

| Feature | Stocks | Crypto |

|---|---|---|

| Volatility | Moderate, tied to economic trends | High, driven by sentiment and market news |

| Regulation | Strong global oversight (SEC, EU, etc.) | Still evolving; varies by country |

| Passive Income Tools | Dividends, ETFs, REITs | Staking, yield farming, crypto savings |

| Historical Returns | Consistent long-term growth | Explosive short-term gains, but high uncertainty |

| Liquidity | Very liquid (especially ETFs) | High liquidity, but varies by token/platform |

| Risk Level | Lower risk, more stable returns | Higher risk, potential for bigger losses/gains |

| Beginner-Friendly | Yes — easy to start with apps or robo-advisors | Requires more research and understanding |

| Accessibility | Widely available through brokers | Global access, 24/7 markets |

| Tax Implications | Clearer tax rules in most countries | Complex tax reporting; differs by region |

Quick Takeaways

- 📈 Stocks are ideal for those who prefer a steady, regulated path to passive income with less risk.

- 💹 Crypto suits those seeking higher returns and are comfortable with volatility and learning curves.

Both can play a valuable role in a modern portfolio. In fact, many smart investors are now combining them to diversify income and manage risk — a strategy that’s gaining momentum in the stocks vs crypto discussion.

✅ Tip: Consider starting with a 70/30 or 60/40 stock-to-crypto split and adjust based on your risk tolerance and income goals.

Key Factors to Consider Before Choosing

Before you commit to either side of the stocks vs crypto debate, it’s important to evaluate your personal situation and goals. Both can be excellent sources of passive income — but the right choice depends on more than just potential returns.

Here are the top factors to help you decide wisely:

1. Risk Tolerance

Are you comfortable seeing your portfolio drop 20% overnight? If not, crypto might feel overwhelming.

- Stocks generally offer lower risk and more predictable outcomes.

- Crypto can be highly rewarding but is far more volatile and emotionally demanding.

💡 Tip: If you’re new to investing, start small in crypto and lean more into stable stock-based assets.

2. Investment Goals

What are you investing for — short-term cash flow or long-term wealth?

- Choose stocks if you’re looking for steady growth, retirement savings, or monthly dividend income.

- Choose crypto if you’re chasing higher returns or experimenting with digital finance tools.

Your goals will shape not only what you invest in but how much risk you’re willing to accept.

3. Time Commitment

How much time are you willing to spend managing your investments?

- Stock portfolios can be largely automated using robo-advisors or dividend reinvestment plans (DRIPs).

- Crypto often requires ongoing research, tracking updates, and understanding new protocols.

⚠️ Crypto income isn’t as “passive” as it sounds — it rewards those who stay informed.

4. Security & Regulation

Regulation matters — especially when money’s involved.

- Stocks are backed by decades of legal frameworks, making them a safer and more transparent choice.

- Crypto is still developing globally, and some platforms may lack oversight or legal protection.

Always use trusted platforms and secure wallets, especially in crypto.

5. Liquidity & Accessibility

Do you want access to your money anytime?

- Both stocks and crypto are highly liquid — but crypto trades 24/7, which may be an advantage for global users.

- Make sure the assets you choose don’t lock you in for long periods (especially with staking or yield farming).

✅ Final Word: There’s no universal winner in the stocks vs crypto conversation. The best strategy is the one aligned with your mindset, goals, and lifestyle.

Hybrid Strategy: Why Not Both?

If you’re stuck in the stocks vs crypto dilemma, here’s the truth: you don’t have to choose just one. In 2025, many smart investors are combining both to create a balanced and diversified passive income portfolio.

This hybrid approach lets you enjoy the stability of stocks and the high-yield potential of crypto — while minimizing risk through diversification.

Why a Mixed Strategy Makes Sense

Each asset class plays a unique role in your income strategy:

- ✅ Stocks offer long-term reliability and consistent dividend payouts.

- 🚀 Crypto brings higher returns and innovative earning options like staking.

By using both, you’re not putting all your eggs in one basket — and that’s a key principle in successful investing.

Example Allocation for Young Investors

Here’s a simple breakdown to start with (you can adjust based on your risk tolerance):

- 60% in dividend-paying stocks and ETFs

- 30% in crypto staking or savings platforms

- 10% cash buffer or emergency fund

This model provides income, upside potential, and flexibility.

Tools to Build a Hybrid Portfolio

These platforms make managing a mixed strategy easier:

Look for platforms that offer features like auto-invest, staking, and real-time tracking — especially if you’re just starting out.

Key Tips for Success

- 🔒 Rebalance quarterly to stay aligned with your goals.

- 🧠 Keep learning — crypto evolves fast, and stocks react to economic changes.

- 📱 Use apps to track both portfolios in one place (e.g., CoinStats, Sharesight).

💡 The smartest move in the stocks vs crypto debate might be saying: “I’ll take both — but strategically.”

Beginner-Friendly Tools to Start in 2025

Getting started in the stocks vs crypto world doesn’t have to be overwhelming — especially in 2025, when there are dozens of beginner-friendly platforms designed to simplify the process. Whether you’re interested in earning dividends or staking crypto, the right tools can help you build passive income from day one.

Best Platforms for Stock Investing

If you’re leaning toward stocks, these apps offer a clean user experience and powerful features without the complexity:

- Robinhood – Ideal for U.S. users, commission-free trading with a simple interface.

- Trading 212 – Great for Europeans; invest in stocks and ETFs with fractional shares.

- eToro – Social investing features and access to both stocks and crypto.

- Interactive Brokers – Advanced features, low fees, and global market access.

🛠 Tip: Look for platforms that support dividend reinvestment (DRIP) and automated investing for long-term growth.

Best Platforms for Crypto Passive Income

For those exploring the crypto side of the stocks vs crypto debate, these tools make earning passive income easy — even for beginners:

- Coinbase – Beginner-friendly UI, supports staking ETH, SOL, and more.

- Binance Earn – Offers fixed and flexible staking options with varying APYs.

- Kraken – Highly secure platform with simple staking functionality.

- Nexo – Crypto savings accounts with daily interest payouts and asset-backed lending.

- Lido – Popular for ETH staking with liquidity options via stETH.

💡 Pro Tip: Start with a small amount to test the process and understand how APYs and lock-up periods work.

Tools to Track and Automate

Managing both assets? Use these apps to stay organized:

- CoinStats – Tracks crypto holdings across wallets and exchanges.

- Sharesight – Visualizes stock performance and dividend income.

- Delta – All-in-one tracker for crypto and stocks.

- Revolut – Combines budgeting, stock investing, and crypto in one app (perfect for EU users).

✅ The first step is always the hardest — but with the right tools, anyone can join the stocks vs crypto journey and start building long-term passive income today.

Real-World Examples and Testimonials

One of the best ways to understand the stocks vs crypto debate is by looking at real people who’ve actually tried both. Numbers and theories are useful, but real-life stories show what works — and what to watch out for.

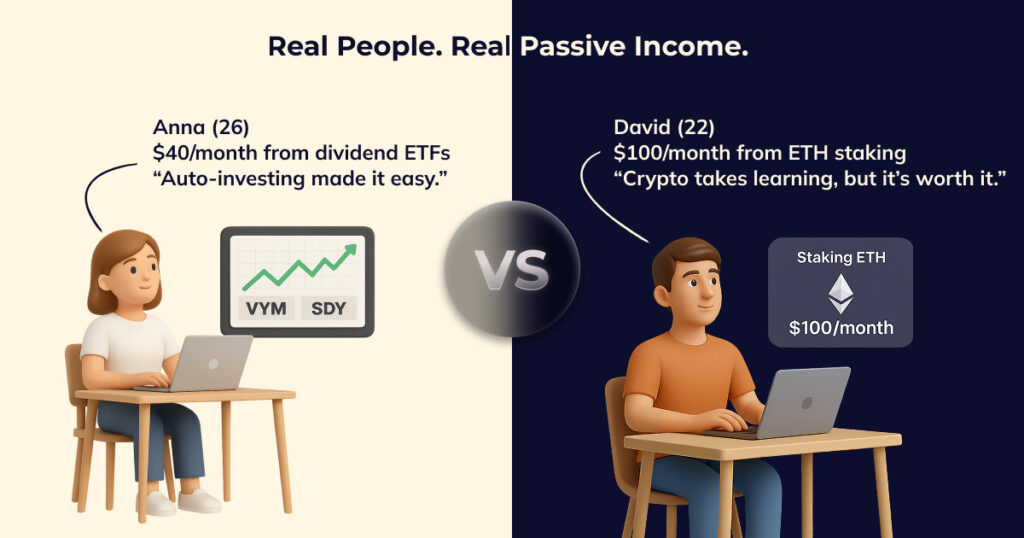

Here are two beginner-friendly case studies from young investors building passive income in 2025:

💬 Anna (26) – Earning $500/year from Dividend Stocks

Anna started investing in dividend-paying ETFs at age 24 using just $50/month. She used Trading 212 to buy fractional shares in funds like Vanguard High Dividend Yield ETF (VYM) and SPDR S&P Dividend ETF (SDY).

“I didn’t know much at first, but auto-invest made it simple. Now I make around $40/month in dividends, which I reinvest automatically. I love the peace of mind.”

- ✅ Safe, predictable income

- ✅ Easy to manage through apps

- ✅ No stress from daily price swings

Anna’s advice? Start small, stay consistent, and let time do the work.

💬 David (22) – Earning $100/month from ETH Staking

David leaned into crypto. He started staking Ethereum on Lido in early 2024 with $1,000 and added more each month. By 2025, he was earning around $100/month in staking rewards — all while holding a long-term mindset.

“Crypto isn’t as passive as stocks, but the returns are better — if you know what you’re doing. I read daily updates and keep my funds on a hardware wallet for safety.”

- 🚀 High APYs through ETH staking

- 🔐 Learned to self-custody assets

- 📚 Ongoing learning curve

David’s tip? Don’t treat crypto like a get-rich-quick scheme. It’s a tool — use it wisely.

Key Takeaway

The stocks vs crypto decision isn’t one-size-fits-all. Anna and David found success in different ways — and so can you. The best approach often comes down to:

- Your risk tolerance

- Your time availability

- Your income goals

🧠 Be like Anna: consistent and long-term-focused. Or like David: curious, informed, and agile. Or — best of all — be both.

Final Verdict: Which Is Better in 2025?

So, stocks vs crypto — which one wins in 2025? The answer isn’t as black and white as some might hope. It depends entirely on your goals, risk tolerance, and how involved you want to be in managing your passive income.

Let’s break it down:

✅ Choose Stocks if you:

- Prefer long-term, steady growth

- Want lower risk and more regulation

- Like the idea of earning dividends with minimal effort

- Are investing for retirement or consistent income

Stocks are ideal for those who value stability, automation, and historical reliability. Tools like ETFs and DRIPs make stock investing simple and sustainable.

✅ Choose Crypto if you:

- Want potentially higher returns — and are okay with higher risk

- Are comfortable learning new technologies

- Have time to research, track trends, and adapt

- Enjoy innovation and fast-moving markets

Crypto rewards those who are proactive and curious. Staking, yield farming, and decentralized platforms offer cutting-edge ways to earn — but only for those ready to stay informed.

⚖️ Or Better Yet… Choose Both

In 2025, a hybrid strategy is often the smartest move. Combining both stocks and crypto allows you to:

- Diversify risk

- Tap into multiple income sources

- Balance short-term gains with long-term stability

Even a 70/30 or 60/40 split (stocks/crypto) can create a solid foundation for passive income.

💬 The real question isn’t “stocks vs crypto” — it’s how you can use both to build the financial life you want.

FAQs About Stocks vs Crypto for Passive Income

Still debating stocks vs crypto for passive income in 2025? You’re not alone. Here are the most common questions new investors ask — with simple, actionable answers to help you move forward confidently.

Stocks vs Crypto: Top Passive Income Choice for 2025

Tired of trading hours for dollars? You’re not alone — more and more young people…

Rich vs Poor: Key Habits That Make All the Difference

Ever wonder why some people seem to build wealth effortlessly while others struggle no matter…

LearnWorlds Reviews: Everything You Need to Know in 2025

Thinking about launching your own online course, but overwhelmed by all the platforms out there?…