The stock market crash 2025 has sent shockwaves across both traditional and crypto markets. For young investors, this may feel overwhelming — especially if you’re new to investing or just started building your financial future. But market crashes aren’t the end. They’re cycles — and opportunities.

In this beginner-friendly guide, we’ll break down what’s happening, explore the bear market psychology, and show you how to stay smart, calm, and financially safe during a financial crisis 2025. Whether you’re in Europe or the US, this article is your go-to survival kit.

What’s Happening in the Stock and Crypto Market?

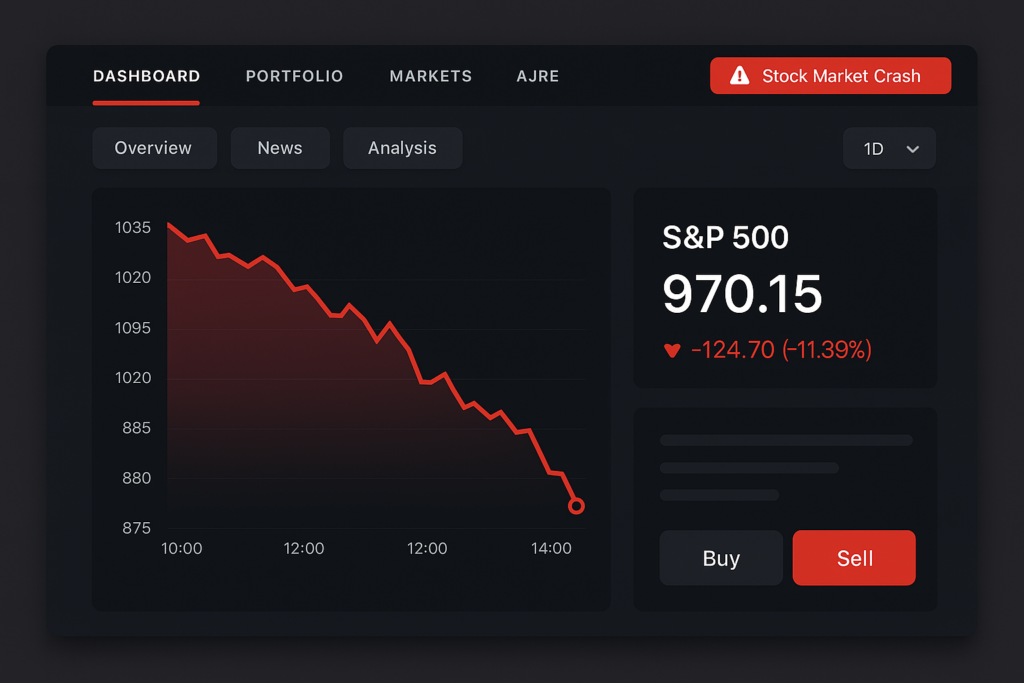

The global markets are seeing a steep decline. Major indices like the S&P 500, NASDAQ, and FTSE 100 have dropped significantly, and cryptocurrencies like Bitcoin and Ethereum have followed suit.

Why Is the Market Crashing?

- Rising interest rates to fight inflation

- Geopolitical tensions

- Declining consumer confidence

- Overvaluation in tech and crypto sectors

- Investor panic and sell-offs

This has triggered a bear market, defined as a 20%+ decline from recent highs — and that’s where understanding psychology becomes key.

Understanding Bear Market Psychology

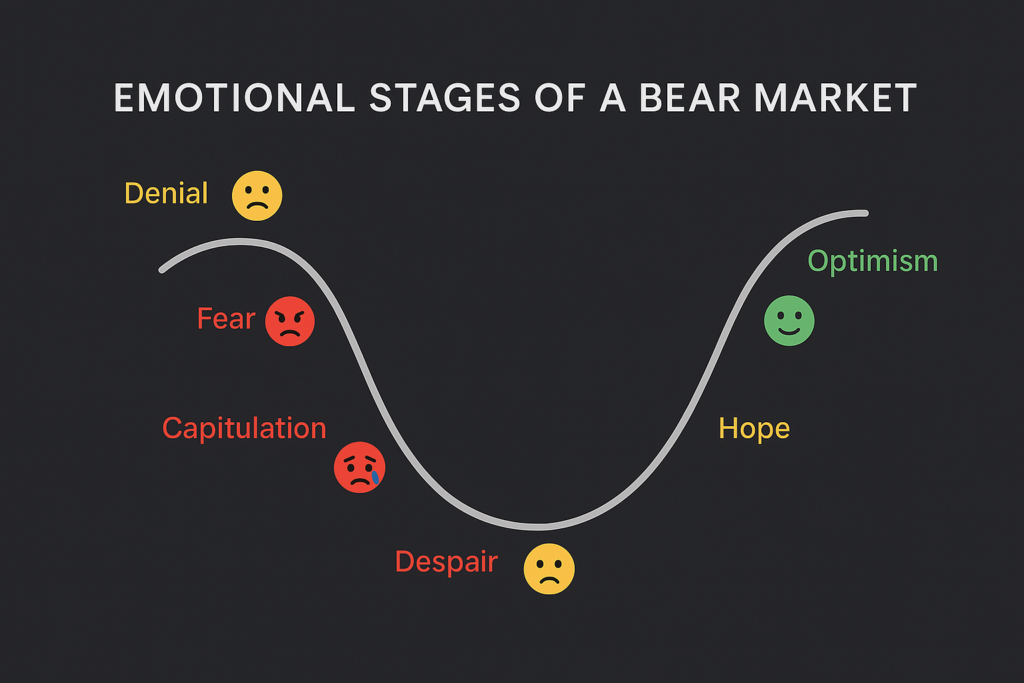

Bear market psychology follows a pattern that’s crucial to understand if you want to make smart decisions:

- Denial – “This is just a dip.”

- Fear – “Should I sell everything?”

- Capitulation – Selling at a loss, often near the bottom.

- Despair – “Investing doesn’t work.”

- Hope – Slow recovery begins.

- Optimism – Long-term trend resumes upward.

Knowing these phases helps you stay emotionally stable and avoid making decisions based on fear.

What Should Young Investors Do?

1. Don’t Panic — Think Long-Term

Adopt a long-term investing mindset. Market crashes are temporary. Historically, markets always recover — often stronger than before. The key is to stay invested in quality assets and avoid emotional reactions.

Example: After the 2008 crash, the S&P 500 recovered over 300% in the following decade.

2. Review Your Financial Priorities

Ask yourself:

- Do I have an emergency fund?

- Am I overexposed to high-risk assets?

- Can I afford to wait 5–10 years for returns?

Emergency Fund vs Investing: Which Comes First?

Before investing aggressively, build an emergency fund — 3 to 6 months of expenses. This helps you avoid selling assets during downturns to cover unexpected costs.

“Emergency fund vs investing” isn’t a debate. It’s a strategy: fund first, then invest.

Safe Assets in Volatile Markets

During times of uncertainty, shift part of your portfolio to safer investments, such as:

- Government bonds (like U.S. Treasuries)

- High-yield savings accounts

- Gold and precious metals

- Dividend-paying stocks

- Defensive sectors (healthcare, utilities)

These can help stabilize your portfolio when everything else is swinging wildly.

Is It a Good Time to Buy?

Yes — but carefully. Crashes often present buying opportunities for those with a long-term view. Focus on:

- Broad market ETFs (e.g., S&P 500, Euro Stoxx 50)

- Strong individual companies with solid balance sheets

- Dollar-cost averaging (investing a fixed amount regularly)

“Time in the market beats timing the market.”

Crypto During a Crash: Risk or Opportunity?

Crypto markets are even more volatile than stocks. For young investors:

- Don’t go all in — crypto should be a small percentage of your portfolio

- Use cold wallets for security

- Stick with established coins like BTC and ETH

- Avoid panic selling — wait for recovery

How to Stay Calm in a Financial Crisis 2025

- Limit your news intake — fear sells

- Journal your investing thoughts

- Talk to others (forums, finance subreddits, Discord groups)

- Read books or follow trusted financial blogs

Examples of Trusted Blogs:

- NerdWallet – Beginner finance & investing tips

- The College Investor – For Gen Z and Millennial investors

- Investopedia – Financial education

- The Balance – Personal finance advice website

Conclusion: You’ve Got This!

The stock market crash 2025 might feel like the end — but it’s just another beginning. With the right mindset, knowledge, and strategy, you can protect your finances and even grow your wealth during turbulent times.

Remember:

- Stay calm

- Think long-term

- Diversify

- Learn continuously

This is your chance to build smart financial habits early — ones that will last a lifetime.

FAQ

What causes a stock market crash?

Typically, a combination of economic downturns, inflation, panic selling, and geopolitical issues.

Should I sell all my investments during a crash?

Usually, no. Selling in panic often leads to losses. Focus on long-term strategy and only rebalance if necessary.

Is crypto a safe investment during crashes?

Crypto is highly volatile. Keep it a small part of your diversified portfolio.

How can I protect myself financially?

Build an emergency fund, reduce high-risk exposure, and focus on quality investments.

Where should I invest safely?

Look into government bonds, defensive sectors, and dividend stocks during volatile periods.